what are the two tools of fiscal policy that governments can use to stabilize an economy?

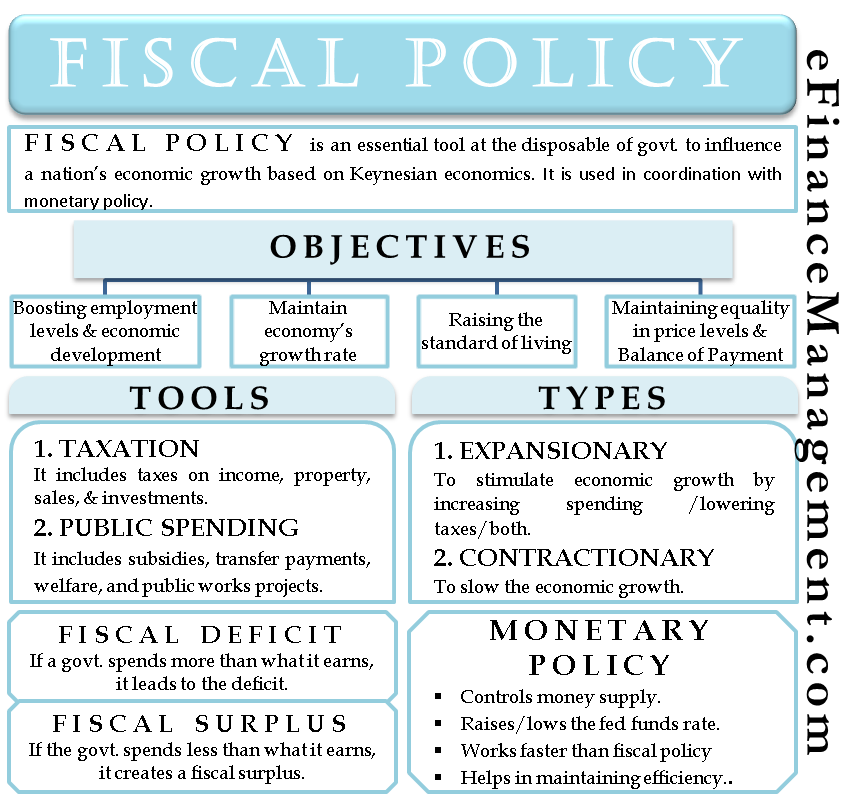

Fiscal policy is an essential tool at the disposable of the authorities to influence a nation'south economical growth. The fiscal policy is used in coordination with the monetary policy, which a central bank uses to manage the money supply in a country. The meaning, types, objectives, and tools are discussed in detail below.

What is a Fiscal Policy?

A government uses fiscal policy to adjust its spending and tax rates to monitor and influence the operation of the country. The financial policy is based on Keynesian economics, which is a theory past economist John Maynard Keynes. As per the theory, a government tin can play a major part in influencing productivity levels in an economic system by adjusting the tax rates and public spending.

Table of Contents

- What is a Financial Policy?

- Objectives of Financial Policy

- Fiscal Policy Tools

- Types of Financial Policy

- Expansionary Fiscal Policy

- Contractionary Fiscal Policy

- A Counterbalanced Approach

- Who All are Affected with Fiscal Policy?

- Fiscal Surplus and Fiscal Deficit

- Monetary Policy – How It'southward Different?

- Conclusion

So, the fiscal policy helps in decision-making inflation, addressing unemployment along with ensuring the wellness of the currency in the international market. Now that we know what is fiscal policy, let's understand its objectives and types.

Objectives of Fiscal Policy

- Boosting employment levels

- Maintain or stabilize the economy'southward growth rate

- Maintain or stabilize the cost levels

- Encourage economic development

- Raising the standard of living

- Maintaining equilibrium in Remainder of Payments.

A authorities has two tools at its disposal under the fiscal policy – tax and public spending.

Taxation includes taxes on income, belongings, sales, and investments. On the one paw, more taxes means more income for the authorities, but it also results in less income in the mitt of the people.

Public spending includes subsidies, transfer payments, like salaries to a govt. employee, welfare programs, and public works projects. Those who get the funds have more money to spend.

Types of Fiscal Policy

In that location are ii types of fiscal policy – expansionary and contractionary financial policy.

Expansionary Fiscal Policy

A authorities uses this type of policy to stimulate economical growth by increasing spending or lowering taxes or both. The objective of this policy is to ensure more coin in the hands of the citizens and then that they spend more. More spending, in plough, leads to more than income and more job creation as well.

There have been debates over which is more effective – tax cuts or spending. Some say that spending in the form of public projects ensures that the money reaches the consumers. Those in favor of the tax fence that tax cuts allow businesses to hire more staff. Though there is no consensus on which of the two is better, the regime uses a combination of both tools to boost economic growth.

Contractionary Fiscal Policy

A regime rarely uses this policy as it aims to slow economic growth. You must exist thinking about why any government will want to do that, the answer is to curtail inflation. Also much inflation has the potential to damage the economy in the long term. And so, the government has to stride in to control aggrandizement.

Here also, the government has the same tools at its disposal – spending and tax cuts. Just, they are used differently – taxes are raised while the spending is reduced. One can easily imagine how unpopular such measures will be among the voters.

A Balanced Approach

A government always faces a risk that more spending and lower tax rates could fuel aggrandizement. This happens because more money in the economy pushes the consumer need upwards, eventually leading to a fall in the value of money. This means that it now takes more coin to buy a product or service, whose value is not changed.

And so, information technology is very important for a government to monitor its fiscal policy constantly. And, if there are any signs of inflation going out of command, the government must address it appropriately.

Who All are Affected with Fiscal Policy?

Financial policy may not benefit all the citizens in the aforementioned way. The scope of the policy depends on the goals that the policymakers aim to achieve. For example, if the government spends more on defense projects, it would benefit simply a few. But, if the spending is on the construction of dams, the benefit would achieve a larger group. Similarly, changes to a particular tax slab would affect but the people falling in that category.

Fiscal Surplus and Fiscal Deficit

Both of these terms are important concepts of fiscal policy. If a govt. spends more than than what information technology earns, it leads to the deficit. The government and so needs to borrow funds from external sources to maintain the residuum.

If the govt. spends less than what it earns, it creates a financial surplus. Though the concept sounds bang-up, information technology's very rare you volition hear a country getting surplus.

Monetary Policy – How It's Different?

The monetary policy helps in controlling the money supply. In that location are many tools nether the budgetary policy, but the authorities mainly rely on raising or lowering the fed funds rate. Budgetary policy works faster than fiscal policy. To ensure that an economic system remains efficient, policymakers should coordinate both fiscal and budgetary policies.

Conclusion

The financial policy is a tool used by the government to influence the economic functioning of the country. It tin can be of various types and moreover, it tin be in surplus and arrears depending upon the authorities expenditure and funds available.

Source: https://efinancemanagement.com/financial-management/fiscal-policy

0 Response to "what are the two tools of fiscal policy that governments can use to stabilize an economy?"

Post a Comment